We invest with intentionality to help companies progress towards more sustainable business models. Sustainable considerations are at every stage of the investment cycle.

Investment cycle

Investment cycle

We invest with intentionality to help companies progress towards more sustainable business models. Sustainable considerations are at every stage of the investment cycle.

Investing with intentionality

Systematic implementation of action plans to help companies progress towards more sustainable business models:

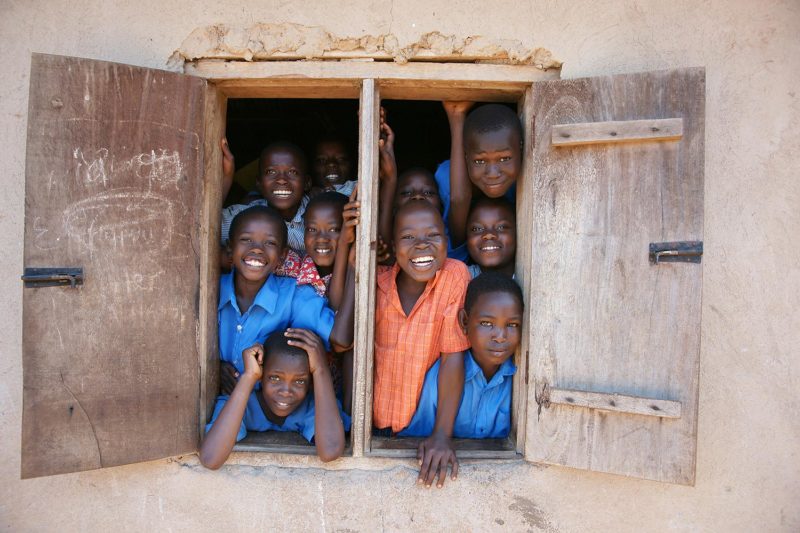

Investing in solutions to sustainable development challenges

Our story

ESG & Impact have been part of Amethis’ investment thesis since its inception in 2012, and we have been implementing a continuous improvement approach ever since.

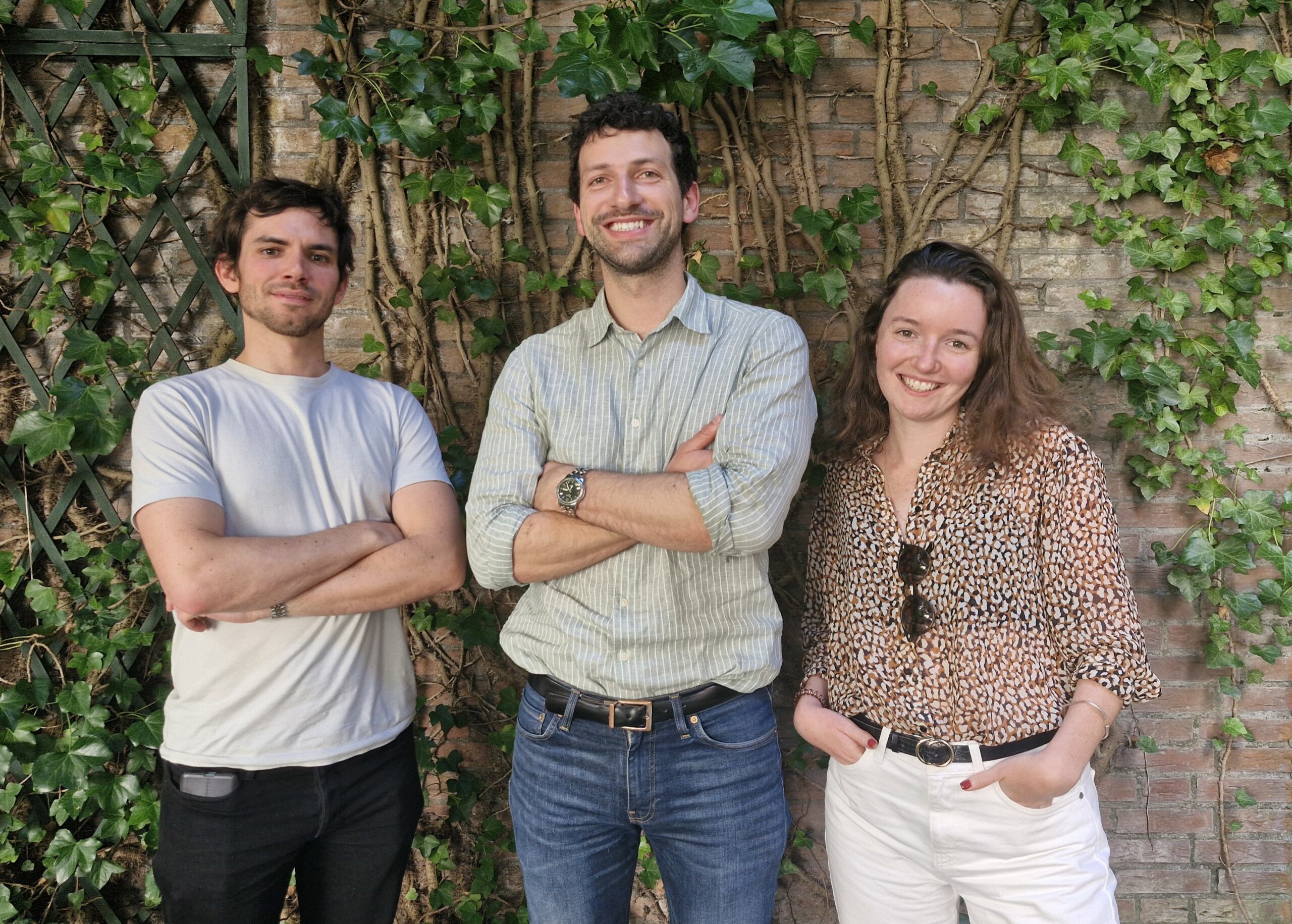

Partners

Footprint

As a responsible private equity manager, we aim to combine financial profitability and economic, social and environmental impact.

To this end, since 2019, Amethis has had a full-time ESG manager, enabling us to effectively monitor our companies’ ESG action plans and to be involved in more and more impact initiatives.

In 2022-2023, we have therefore worked to find ways of facilitating the implementation of our ESG action plans. This has resulted in the recruitment of two new ESG experts, enabling us to spend more time supporting each company.

Documents